“Reversion to the mean,” or, as it’s called, “mean reversion” may sound at first like a phrase you would only encounter in a statistics class. But the fact is, this statistical principle is in operation every day in many circumstances of life.

Stated simply, reversion to the mean refers to the statistical tendency of extreme or unusual results to be followed by more typical or average results over time. Thus, when meteorologists refer to “average temperature,” we understand that some days will be hotter than average, some will be cooler, but over time, daily seasonal temperatures will tend toward an average number. Similarly, in the financial markets, the prices of certain assets may go up or down by an unusual amount in a given period, but over time, their rate of change will tend to move back toward their averages. So, if prices rise dramatically in one year, they are likely to rise by a lesser amount—or fall—in the next year.

Seeing What’s Not Really There

Unfortunately, we tend to ascribe cause-and-effect relationships to this phenomenon, because human beings are pattern-seeking animals. For example, consider the so-called “Sports Illustrated Jinx.” The idea is that when any athlete’s picture appears on the cover of Sports Illustrated, the athlete is doomed to go into a slump. But what’s really happening is mean reversion. Athletes get their pictures on the cover of the magazine because of above-average performance; mean reversion indicates that they are then due for a period of performance closer to the average. However, as humans, it is easier for us to ascribe this to some extraneous cause—like a “curse”—rather than simple statistics. Similarly, investors sometimes incorrectly ascribe cause-and-effect relationships to asset price movements—last year’s performance of a particular mutual fund, for example—rather than allowing for the operation of mean reversion. Another way of saying it is that many investors, seeking to discern a pattern in price movements, ascribe a correlation between certain variables that, are in fact, are either non-correlated or only weakly correlated.

This principle is very important for investors to understand. While it is impossible to predict the short-term future price movement of any asset with more than random accuracy, knowing about mean reversion can help investors avoid some common tendencies that often cause portfolios to underperform over time. For example, a study by the Wall Street Journal found that certain domestic mutual funds achieving five-star ratings from the research firm Morningstar in a given year were more likely to receive lower ratings in the subsequent three, five, and ten years. Does that mean that the fund managers became less proficient over time? Not necessarily. It does indicate that the performance of the funds reverted toward the mean. In other words, a five-star rating in one year is only weakly correlated with the fund’s performance in later years. Or, to use a phrase that most investors see fairly often, “Past performance is no guarantee of future results.” And yet, some investors will switch from fund to fund, based on recent performance, only to watch their most recently chosen fund revert to the mean. Over time, this type of financial decision-making can cost dearly in lost long-term value.

Mean Reversion and Portfolio Construction

But investors can also utilize mean reversion in ways that can lead to better long-term results. Especially when an understanding of mean reversion is coupled with an investor’s approach to broad asset classes, it can be beneficial for constructing portfolios that are designed to take advantage of the way the markets actually work over time.

For example, the historical average return of equities (stocks) over the last century has been 10%. Remember: that is an average; some years the return has been much higher, and in others, it has been much lower. But over a sufficient period of time, an investor with an understanding of mean reversion might expect to earn an average return, over time, of about 10% from a stock portfolio.

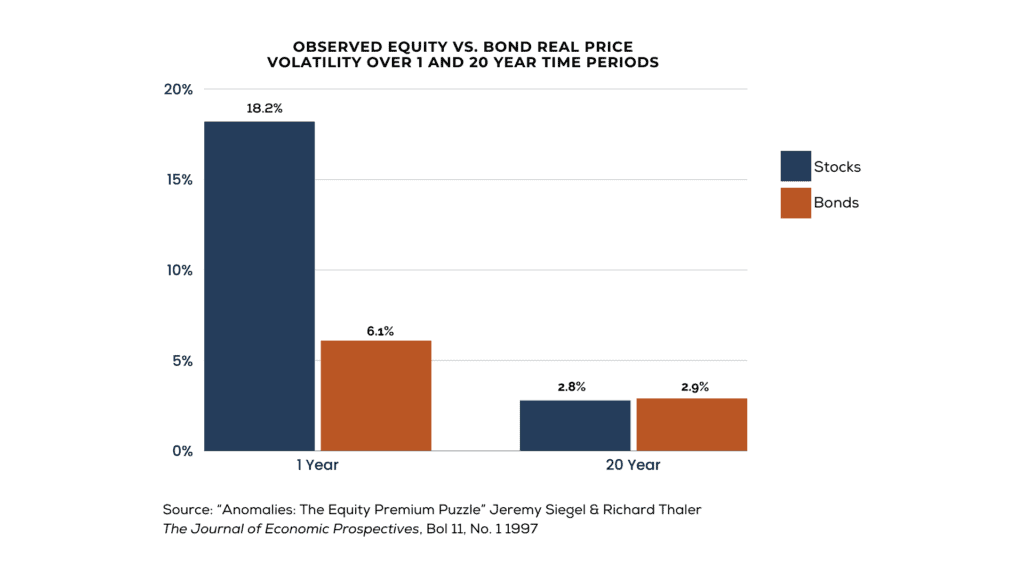

Of course, stock prices exhibit much more volatility (swings in prices) than other investment types, which means that in a given year, they could change by 15% or more, in either direction. But once again, mean reversion suggests that volatility, like other phenomena, tends to move back toward an average level over time.

Consider the above chart. When stock price volatility is viewed in a short time frame—1 year in this example—it can be quite high. But when we look at volatility over a longer period—20 years in the above chart—it approaches a much lower level, comparable to the volatility of bonds, which tend to exhibit much less volatility than stocks.

This means that, for an investor with an appropriate time frame, mean reversion suggests both the likelihood of strong returns and modest volatility over time.

What This “Means” for You

A basic understanding of mean reversion also has benefits beyond portfolio construction. Perhaps one of the most important advantages is emotional: it can help you avoid making important financial decisions based on emotions stimulated by short-term price conditions. Remember: we tend to “find” patterns or causes in price movements that aren’t there. Simply knowing about the statistical realities behind asset prices can provide you with the stability you need to remain committed and patient, even in the face of dramatic price swings. Knowing that both volatility and price performance tend to move toward average levels over time can help you resist the urge to “do something” when the better tactic would be to simply stay in your seat until the ride gets smoother.

At Bondurant Investment Advisory, we provide clients with investment and other financial guidance based on empirical evidence, not the latest headlines. By coupling world-class financial research with our fiduciary obligation to keep clients’ best interests foremost in all we do, we guide investors to better long-term outcomes. We believe that designing portfolios matched to clients’ needs & priorities, and coaching them toward a better understanding of market-tested financial strategies, will help clients utilize portfolios that help them achieve their most important long-term goals. To learn more about how we incorporate mean reversion in the portfolios we construct for clients, schedule a meeting with us. We’d be happy to talk.