It may be surprising to some to realize that the US equity markets comprise only about 50–60% of the world’s total market capitalization. Especially when you consider that US investors, on average, confine their international holdings to around 15% of the portfolio, and considerable research suggests that to achieve proper diversification, they should be holding perhaps double that, the problem of “home bias”—the tendency of investors to overweight equities of their home nation—comes into sharper focus. After all, most of us don’t confine our grocery shopping to just half of the store. And yet, when it comes to building the investment portfolio, many investors may be ignoring significant opportunities for both growth and decreased volatility by overlooking international equities.

In this connection, it’s interesting to consider the opportunities to be found among international emerging markets: those found in developing nations as they increase their engagement with the global economy. Often, emerging markets can present interesting opportunities for growth that can sometimes offset the stagnant conditions that may affect more developed markets. For example, in 2006, when the US equity market as a whole returned 14.7% (which was not bad), Chinese equities returned 82.9%. In 2014, the US led the developed markets with a return of 12.7%, and in that same year, Egyptian equities returned 29.3%. Of course, the opposite can also be true: in any given year, one or more of the emerging markets could exhibit inferior, and even negative returns. As we know, predicting the actual return for any market in a given year is an effort doomed to a low percentage of success.

China as an Emerging Market

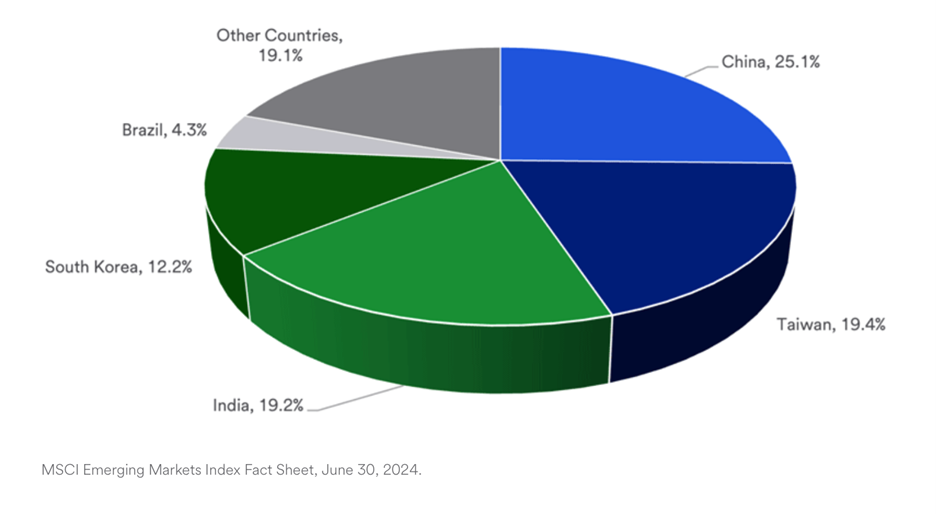

Among emerging markets, China is the largest in market capitalization, at just over $10 trillion and around 25% of emerging markets. In fact, it’s the second largest in the world, lagging only the US (at $54 trillion). China is also the world’s second largest economy, which is another reason that any investment in international and emerging markets should incorporate careful consideration of the unique aspects of investing in Chinese equities.

Economy. The Chinese economy expanded at a 5.2% rate in 2023, and the International Monetary Fund estimates that it will grow by a more moderate 4.6% rate in 2024. One of the main drags on the Chinese economy at present is the property market, plagued by persistently slumping real estate values, particularly in the private residence sector. An aging demographic—despite the dramatic rise of a Chinese middle class since the 1970s—is also a matter of concern. On the other hand, the sheer size and potential of the Chinese market will continue to be a long-term factor in the attraction of participating in the Chinese economy. And some analysts point to the aging population as a frontier of opportunity for healthcare and related industries.

Government policy. Because the Chinese Communist Party exerts such strict control over so many aspects of Chinese society, the regulatory environment can be something of a wild card. For example, a government crackdown on private education companies and non-domestic internet platforms in 2021 placed severe limitations on the business models and performance of companies in these sectors. On the other hand, the government’s stated commitment to renewable and sustainable energy practices may mean that industries like electric vehicle manufacture, solar and wind energy, and other related sectors may enjoy a more favorable regulatory climate.

Geopolitical concerns. Ongoing tensions with the US and other Western countries around Chinese expansionism, trade practices, human rights, and other matters will likely continue to figure large in investment decisions. Especially in the area of trade—for example, the additional tariffs recently imposed on Chinese imports by the Biden administration—decisions made in China and other nations can have a direct effect on the ability of Chinese companies to compete successfully in international markets.

Differences in reporting standards. This is another area where the Chinese government comes into play. Because of Beijing’s insistence on secrecy in areas like unemployment, income growth, and other important economic data, it can be difficult to accurately judge the operating landscape for Chinese companies. Additionally, reporting standards for Chinese companies, while improving, still lag many other countries’ regulations regarding transparency.

Investing in Chinese Securities

For investors considering investing internationally, there some special risks to be considered, including:

- Transaction costs: the special fees, duties, and levies on buying non-domestic securities can be significant;

- Currency risk: If the value of a foreign currency moves adversely to the value of the US dollar, the value of securities denominated in that currency will be similarly affected;

- Liquidity risk: International tensions or even military events could impair the investor’s ability to sell a non-domestic security in a timely fashion.

There are also multiple ways to participate:

- American depository receipts (ADRs): securities issued by a foreign company representing a share of ownership, but denominated in US dollars (internet giant Alibaba issued $25 billion in ADRs in 2014, listing them on the New York Stock Exchange);

- Global depository receipts (GDRs): issued in various currencies, including US dollars;

- Direct investment: requires an international account; may be less suitable for individual investors;

- Foreign mutual funds and ETFs: Many are issued and managed by US mutual fund companies and may offer better diversification than buying individual equities.

As with any type of investing, of course, establishing a position in emerging markets—including China—should be undertaken with the guidance of an advisor who both understands your investment objectives and places your best interests foremost. At Bondurant Investment Advisory, we are committed to providing guidance based on sound evidence and reliable research. If you have questions about incorporating emerging markets into your investment strategy—or any other important financial matter—we would like to talk with you.