Academically Influenced. Data-Driven.

Bondurant Investment Advisory’s story is of seasoned expertise and dedicated client-centric service. Founded by Scott Bondurant, a former Managing Director & Global Head of Long/Short Strategies at UBS Global Asset Management, the firm has a rich history of navigating the complexities of the financial landscape. Scott’s leadership from 2005-2014 in developing, implementing, and marketing a $2.5 billion equity long/short platform has laid the foundation for a firm that values investment expertise and deep relationships with clients. Over the last seven years, Scott’s multifaceted experience, including roles as an Adjunct Professor at Northwestern University, has enriched the firm’s ability to provide holistic financial solutions. Bondurant Investment Advisory is a testament to a commitment to excellence, blending market insights, academic rigor, and a focus on long-term success to craft personalized financial strategies for each client’s unique journey.

Our Investment Philosophy

Our investment philosophy is grounded in a holistic and research-driven approach. Recognizing the significance of mean reversion, the firm incorporates insights from behavioral finance and academic literature into its strategies. The team believes in identifying and capitalizing on discrepancies between market prices and intrinsic values, exploiting market inefficiencies to benefit client portfolios. Our long-term investment approach aligns with the belief that compounding returns play a critical role in achieving enduring financial goals. With a proprietary asset allocation process, Bondurant Investment Advisory strives to optimize risk and return, weaving together a narrative of financial success rooted in thorough research, strategic planning, and a commitment to client well-being.

Our Team

Meet the exceptional team at Bondurant Investment Advisory, where seasoned professionals who have advised and managed money for the world’s largest and most sophisticated investors for over 25 years come together to provide unparalleled expertise.

With a commitment to personalized service and a wealth of experience, our team is dedicated to guiding you on your financial journey with integrity and precision. Leveraging a vast network and access to institutional providers, our team ensures you benefit from an extensive range of resources, enriching the depth and breadth of available financial solutions.

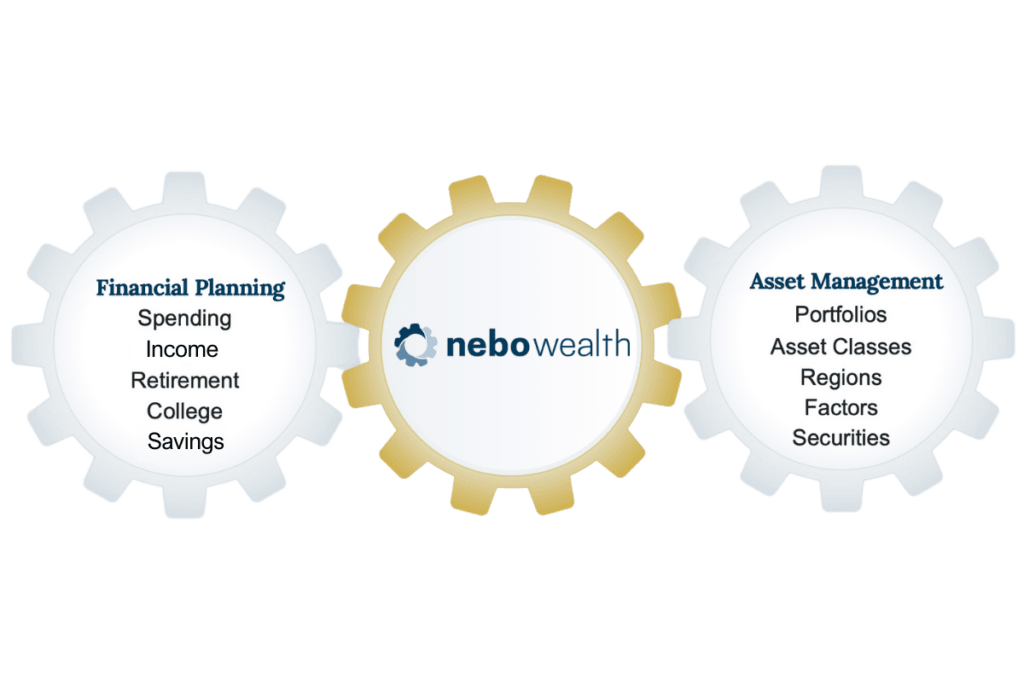

Why We Use Nebo Wealth

Redefining Risk

Nebo Wealth's cutting-edge capabilities enable our team to understand risk comprehensively, allowing for a more nuanced and accurate assessment.

Streamlined Planning

By leveraging Nebo Wealth's advanced features, we streamline the financial planning process, ensuring that our strategies align seamlessly with your unique goals and risk tolerance.

Better Portfolios

Nebo Wealth empowers us to develop more robust portfolios by providing real-time insights and data-driven analysis, enhancing the precision and effectiveness of our investment decisions.

Our Values

Value & Pursuit of Excellence

Dedication & Passion

Research & Data

How Can We Help?

If you’re ready to take control of your financial future, schedule a personalized consultation now to explore tailored strategies that align with your unique goals and challenges.

How Can We Help?

If you’re ready to take control of your financial future, schedule a personalized consultation now to explore tailored strategies that align with your unique goals and challenges.